Active

Active

2901 Abbott Street Unit# 116

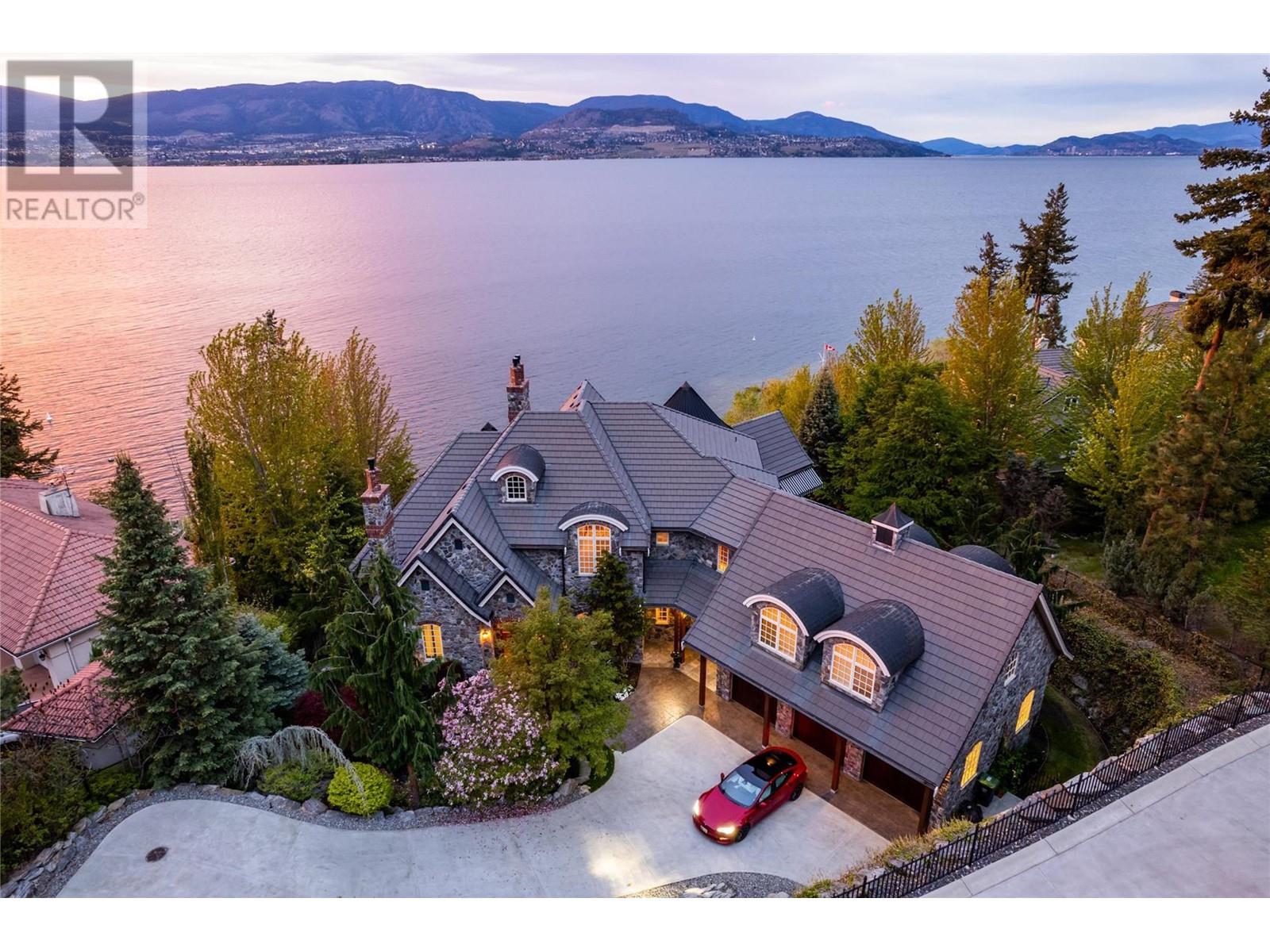

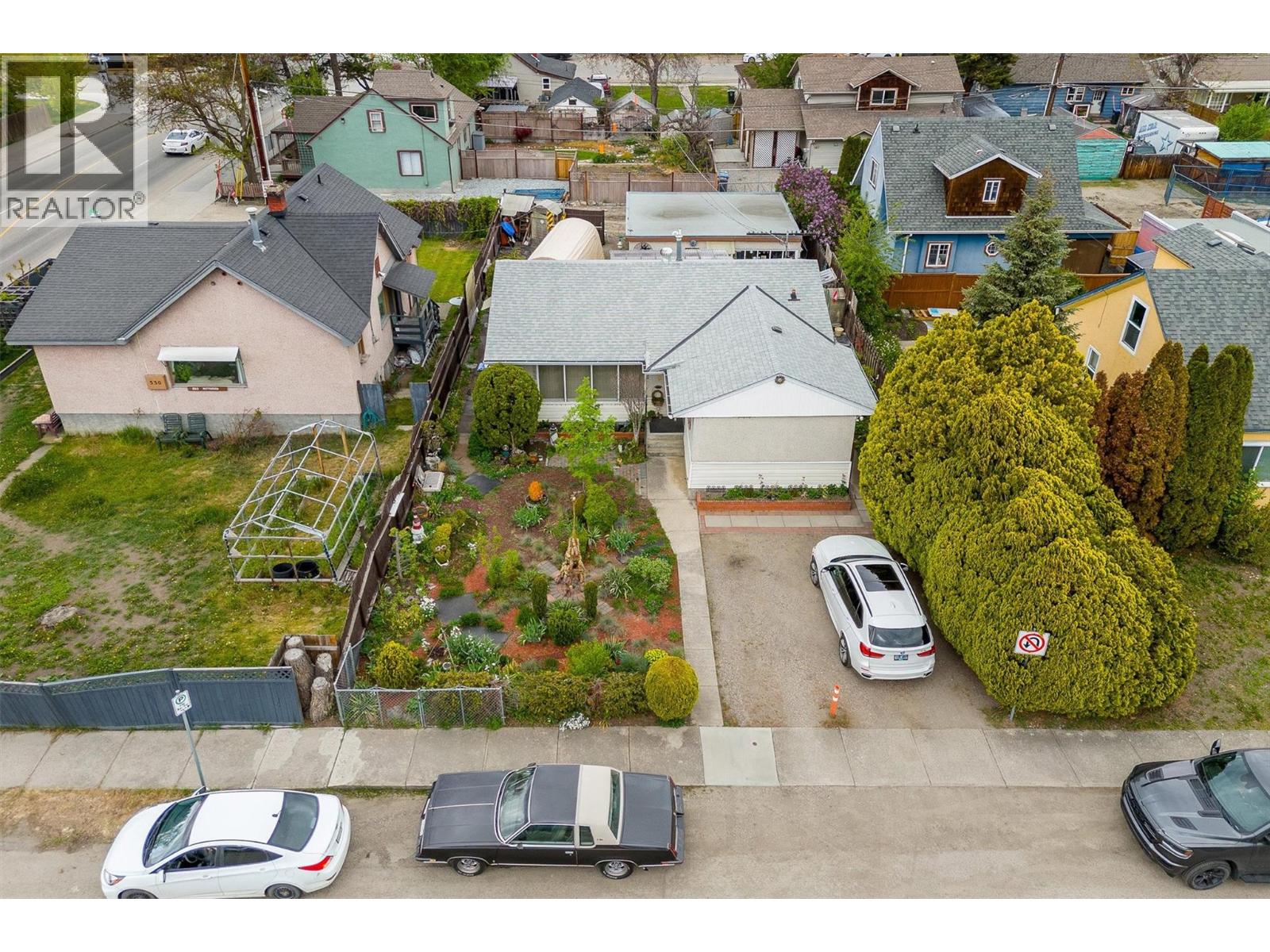

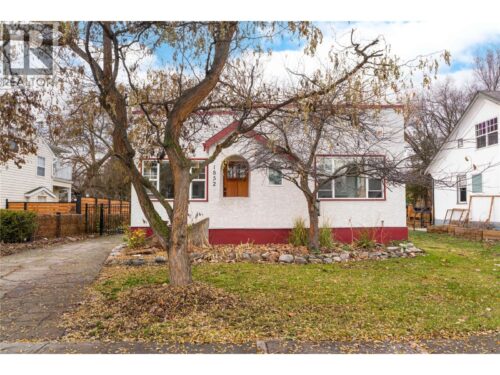

Good neighbours are easy to find in Kelowna, but every neighbourhood has its own unique style and identity.

Picking the community that best fits your lifestyle is one of the most important decisions you have to make. Get all the details on each community’s amenities and attractions so that you can find the perfect neighbourhood to call home .

Take a look at our Kelowna and area neighbourhoods and communities here to discover what it has to offer you.

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Active

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Sold

Start by getting pre-approved for a mortgage. Pre-approval informs you of exactly how much you can spend and locks you in at the current interest rate for 90 days or more. This will let you browse properties knowing exactly what your budget is, which is particularly important when considering potential interest rate increases that can be set by the Bank of Canada.

Don’t wait for the “perfect” time to buy, it simply doesn’t exist. Prices are determined by many factors, such as supply and demand, the overall economy, and many other housing market conditions. The impact of these factors varies not just from city to city, but even neighbourhoods. The best indicator to focus on, when assessing your negotiating power as a buyer, is numbers of days on market for a particular property. Generally speaking, the longer it’s been on the market, the more likely the seller will be to negotiate the price!

Many people believe that mortgage loan insurance protects the borrower, but that isn’t true! The purpose of Mortgage loan insurance is to protect the lender in case the borrower defaults on their payments. Because of this, lenders will take our insurance based on factors such as the down payment percentage, and pass those costs on to the homebuyer/borrower, to be paid either in installments or upfront.